Angel Indexing, Product Placement, HENRY, CATS, DINK & FIRE

We start with a look at whether index investing can work in the world of venture capital. In light of the first major movie release of the pandemic coming out this week (Unhinged with Russel Crowe) we look at how product placement in entertainment is done and how much it really costs for brands to get screentime. Finally, we also cover a few common (and not so common) acronyms in marketing and finance.

Angel Indexing (2 min)

Product Placements (2 min)

Contemporary Acronyms (1 min)

Can an index fund of startups perform better than a traditional VC portfolio?

"The best-performing 4% of listed companies explain the net gain for the entire US stock market since 1926 (as other stocks collectively matched Treasury bills)”

This statement perfectly encapsulates the rationale behind the rejection of active management and stock picking that we have seen in the last couple of decades. As Vanguard and BlackRock have become household names, active management has taken a backseat to index funds and robo-advisors. But why stop with equities in the public market?

A paper by Abraham Othman, head of data science at AngelList, suggests that when it comes to seed rounds investing in every deal is the best strategy possible. According to him: "Investors increase their expected return by indexing as broadly as possible at the seed stage (i.e., by putting money into every credible deal) because any selective policy for seed-stage investing—absent perfect foresight—will eventually be outperformed by an indexing approach." In other words, "If you miss the best-performing seed investment, you will eventually be outperformed by someone who blindly invests in every credible deal".

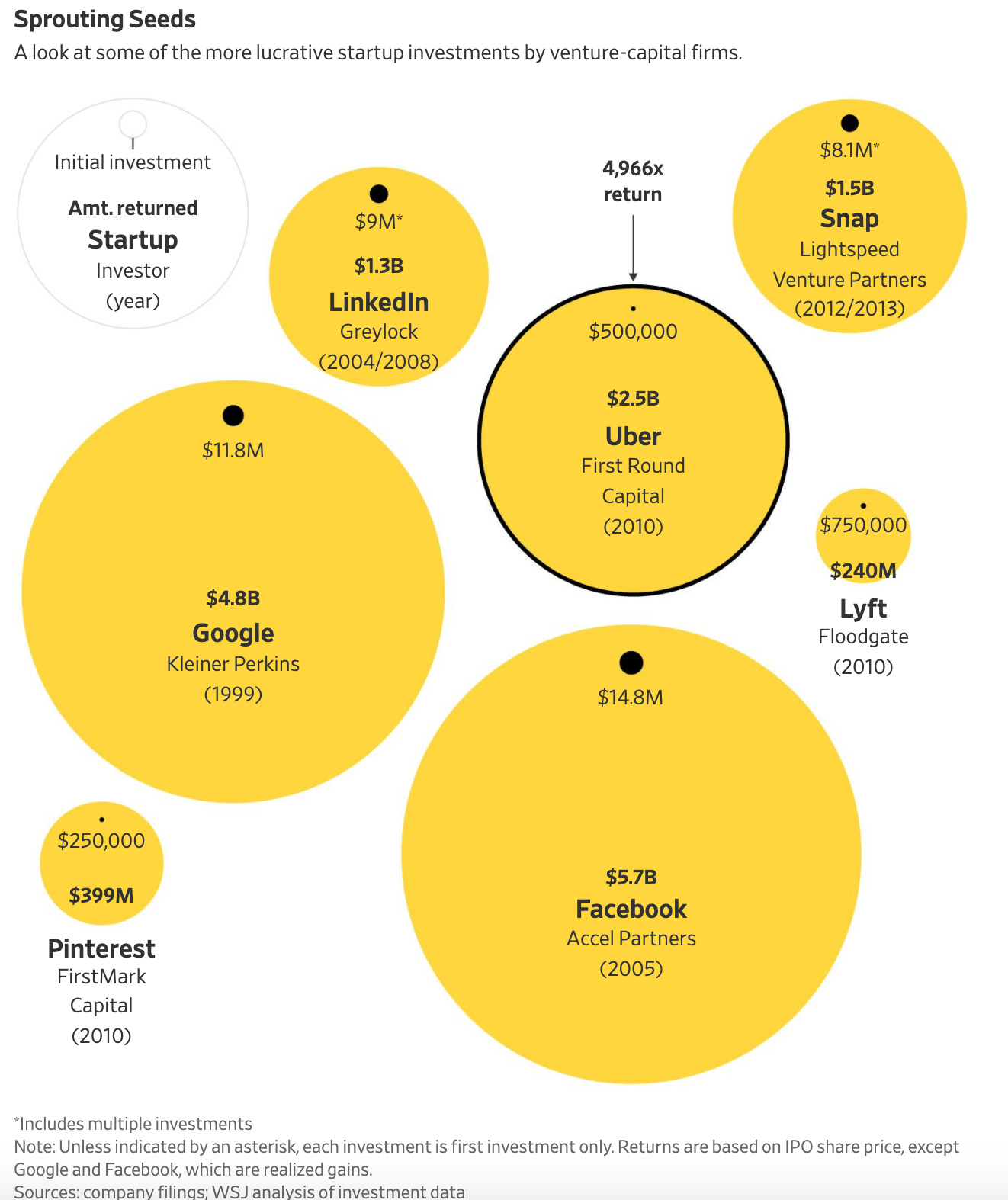

Abraham reached this conclusion by showing that the returns of a single hyper-successful startup investment can be greater than the sum of returns from all other investments. From the graphic above, missing Uber's seed round investment alone would have cost you ~$2.5 billion in expected returns. Of course, knowing what to invest in is only half the battle. Actually getting access to every deal (deal flow) is difficult for even the best VC's to accomplish making this strategy very difficult to successfully implement.

In Other Words

In the realm of seed stage investing the single highest returning investment performs so much better than the average that not investing in it has been shown to produce a lower expected return on capital no matter which other companies you choose to invest in. Thus we can conclude that investing in every credible seed stage company will yield a better return than actually choosing between specific companies.

How does product placement in the entertainment industry work?

Contrary to popular belief box office revenues and pay-per-view sales are not the only way that production studios recoup their costs. Paid product placements have existed nearly as long as the cinema industry itself. The silent film Wings (1927) was one of the first films to have a confirmed product placement (it prominently featured Hershey's chocolate bars). Since then product placement has become a lucractive source production companies have leveraged to generate significant amounts of revenue.

As far back as 1999, MGM sold a record "$100 million worth of placements in The World is Not Enough to such brands as BMW, Bollinger, Turnbull & Asser, Smirnoff, Omega, Motorola, Electronic Arts, Microsoft, Caterpillar, and, Heineken".

In 2012, Heineken paid a reported $45 million for a placement in the movie Skyfall. With a deal of this magnitude, not all of the money goes directly into the production budget of the movie. In addition to a scene in the movie where Bond chooses a beer over his signature cocktail, the deal also included: a 30-second commercial starring Daniel Craig as James Bond and a branded web game featuring Craig and co-star Bérénice Marlohe.

Some portion of the money is also earmarked for cross-promotion where Skyfall benefits from the millions that Heineken spends on beer ads that also mentions the film. Skyfall wasn’t the first movie in which Bond changed his drinking habits at the behest of an eager advertiser. Over the years Bond has been seen on screen imbibing on various drinks including Red Stripe beer, Smirnoff, Absolut, and Stolichnaya vodkas, and Macallan whiskey.

Moving on from the Bond franchise, the 2002 film Minority Report sold almost $20 million in placements. "Toyota paid $5 million to get a futuristic Lexus called the Mag-Lev in Minority Report. Nokia shelled out $2 million for the characters to wear Nokia headsets." Other smaller deals with Gap, Pepsi, American Express, Reebok, and more accounted for another $13 million in advertisements across the movie.

Harley Davidson paid a reported $10 million for Black Widow to ride their electric LiveWire bike in Avengers: Age of Ultron.

Product placement doesn't always involve money changing hands. Netflix rarely accepts cash payment for the products featured in their original films and tv shows. Most of the appearances seen in their content are organic and decisions made by the writers/directors. Their focus is on taking advantage of organic placements to initiate broader advertising campaigns to drive awareness. In the picture above New Coke from the 80’s is prominently featured and last year Coca-Cola ran a promotion where they brought back a limited run of the original formula New Coke to take advantage of the buzz that Stranger Things (pictured above) had generated.

In Other Words

Product placement has existed nearly as long as the cinema industry itself. Movie studios have taken in upwards of $100 million in some cases for featuring a long list of brands prominently in their films. Deals often include other perks such as co-branded commercials and product tie-ins. Netflix is famous for not directly accepting payment for the products that are featured in their original content but they do leverage the placements with broader advertising campaigns from brands (such as the reintroduction of New Coke in 2019).

What do the terms HENRY, CATS, DINK & FIRE refer to?

HENRY is an acronym popular amongst fintech companies which refers to High Earner, Not Rich Yet. Companies such as Chase (Sapphire Reserve) and Goldman Sachs (Marcus and Clarity) have invested heavily to target HENRY's in the belief that they'll be future customers for other more lucrative services both companies offer.

CATS is an acronym that the company Masterclass uses to refer it's target customers: curious, aspiring 30-somethings. According to The Atlantic, "CATS are old enough not to be planning to return to school but young enough that they need help advancing in their career. They’re anxious about their future, their present, and their position relative to that of their peers". So, next time you see an ad for Masterclass in your feed just know that their marketing team thinks very highly of you.

DINK is an acronym from personal finance circles and it refers to Dual Income, No Kids. This represents a couple who are both working professionals but without the associated expenses and time commitment of children. Generally, this is seen as an enviable advantage from the perspective of those looking to reach FIRE (Financially Independent, Retire Early) early in their lives. Sites like the FinancialSamurai, Mr Money Mustache, and reddit communities (FIRE) have sprung up in service of the growing number of people who self-identify with these terms.

In Other Words

HENRY: High Earner, Not Rich Yet

CATS: Curious, Aspiring 30-Somethings

DINK: Dual Income, No Kids

FIRE: Financially Independent, Retire Early

That’s all for this week. Thanks for making it this far and I hope you found these answers as interesting to read as I found them interesting to write. If you liked what you read feel free to share it with someone who you think will enjoy this type of content.

As always,

Roosh → You