Ass Insurance + Monopoly Money: Google and Apple as Dictators

This week we start with a look at a fairly exotic corner of insurance (body part insurance) and discuss the implications of the unbundling of the individual as a unit of value. Next, we turn to the former dictator of Indonesia, Suharto, to give us an example of how much monopolies can hurt an industry (and how monopolies of this sort are different from Apple and Google's actions today).

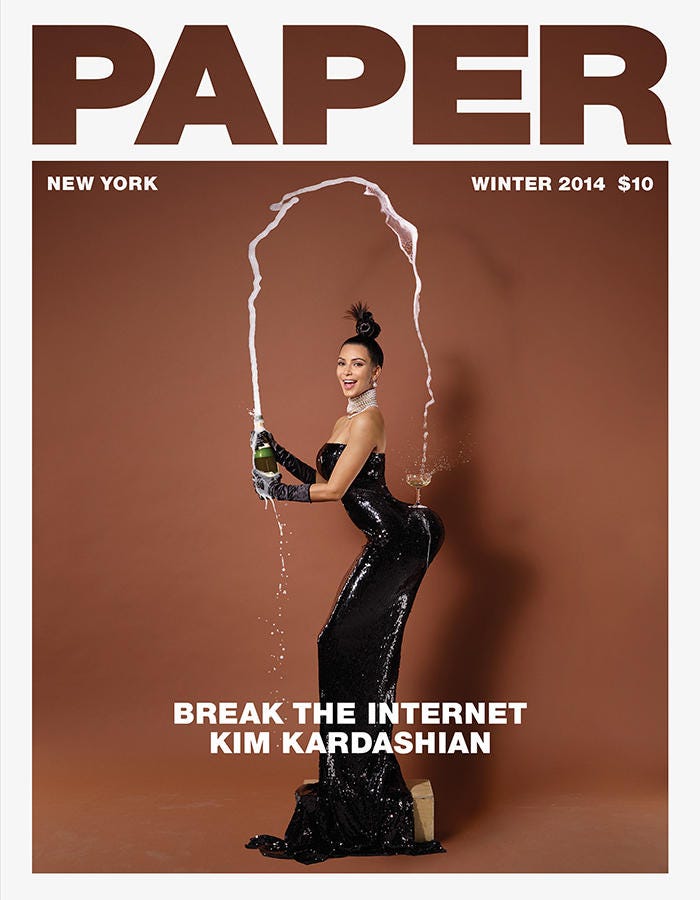

Ass Insurance (1 min)

Monopoly Money: Google and Apple as Dictators (3 min)

What is body part insurance and what are the implications of being able to value specific parts of your body?

The purpose of body part insurance is to supplement lost income for a person if a specified body part is damaged, injured, scarred, handicapped, or lost. In many ways, it can be seen as the ultimate unbundling of the individual as a unit of value. Singers vocal cords, chefs taste buds, and a painters hands generate an outsized amount of utility relative to their other limbs, and being able to value them separately means a whole new class of financial products are now possible.

One of the earliest known policies was written for the cross-eyed silent film actor, Ben Turpin, who was to be given $100,000 in the event that his eyes became straight. Other famously insured body parts include Gene Simmons tongue ($1 million), Keith Richards middle finger ($1.6 million), Madonna's breasts ($2 million), Taylor Swift's legs ($40 million), and Kim Kardashian's ass ($21 million).

The idea behind the policies is that should a body part that is insured be out of commission or unable to be shown/used as normal, then the insurer would pay the total amount of the coverage (over a specified period of time). Then the star would be able to recoup the "losses" they would have sustained while not being able to utilize the insured portion of their body.

But why stop with insurance? We're not far from a world where Kim Kardashian can treat her ass like a liquid asset. Perhaps eventually she'll be able to take out a loan with her ass as collateral. Should she default, the originator of the loan could "foreclose" her ass and be able to collect revenue from certain types of ads and sponsorships that her ass is directly involved in to recoup the losses on the loan. Or perhaps certain types of cosmetic surgery for influencers could be financed using some form of Income Share Agreements whereby the influencer has to pay a percentage of their future sponsorship income over a period of time but gets the surgery for free.

All of this and more is made possible by the unbundling of the individual and the ability to value certain aspects of a person’s body (or even their mind) in ways that were previously inconceivable.

In Other Words

Body part insurance started as a way for Hollywood stars to insure distinctive portions of their bodies should they ever get injured and be unable to work (ensuring that their income wouldn't dry up immediately). Today it represents a new asset class that could potentially unlock a myriad of new financial products for the next generation.

What are the differences between Indonesian cigarette corruption and tech anti-trust battles?

The WHO (World Health Organization) ranks Indonesia third in the world with regards to the total number of smokers. 63% of adult men smoke and in 2008 over 165 billion cigarettes were sold in the country. 9 out of 10 smokers in Indonesia prefer a particular type of cigarette that's indigenous to the country called the "kretek". Kreteks are cigarettes rolled with cloves, tobacco, and cocoa.

In the 1990's the Indonesian dictator Suharto setup regulation so that all local cigarette manufacturers were forced to buy from a company his son Tommy had set up (known as BPPC), which also controlled clove imports from other countries (and thus had complete control of clove prices). With the stroke of a pen, he gave his son a virtual monopoly on the market for cloves in Indonesia.

The effect on the industry was immediate. A farmer "sold his cloves to the local cooperative for 5,000 rupiah a kilo but would receive only 3,000 in cash--the rest “saved” for him by the bureaucracy. The cloves traveled up the BPPC ladder, officials taking 2,000 for “participation in clove trading” fees here, and a 1,000 rupiah charge to persuade farmers to grow other crops there, plus a 2,000 rupiah charge to cover the BPPC’s interest and operating costs at the end. By the time the cloves reached the cigarette factory, that kilo cost 12,000 rupiah (about $1.20 at the time which was three to four times the world market price).

But the monopoly was a disaster. Because prices for cigarette manufacturers were set artificially high, clove production increased as kretek consumption dropped, leaving many farmers with tons of unsold cloves. At one point, BPCC publicly called for farmers to burn half their crop, and the Suharto Government was eventually forced to bail out the industry with credits totaling almost $350 million.

The problem with monopolies of this nature can be summed up with one word: choice. Cigarette manufacturers in Indonesia had no choice but to buy cloves from the company Suharto's son had setup. Instead of adjusting their production and prices based on supply and demand in the market, they were forced to pay artificially high prices (3-4x the going rate) for cloves which ultimately ended up completely distorting the market and ruining many farmers livelihoods (while simultaneously cutting into the profitability of kretek cigarette production as well).

In today's world, Apple and Google stand accused of being "dictators" of the ecosystems under their control (iOS and Android respectively). And to some extent, these accusations have a ring of truth to them. Like any leader or government, Apple and Google are the arbiters of what is considered lawful behavior on their platforms and enforce their rules judiciously. However, unlike true monopolies, they don't deign to take away consumer choice. They merely adopt a favorable default choice (Google Maps and Google Search on Andriod and iMessage on iPhone) and allow consumers to decide for themselves which services to use.

Most people would agree that the stranglehold on the clove market that Suharto and his son Tommy had in the 1990s was bad for the economy and for the country of Indonesia. It's less clear why Google leveraging its dominant position in Android to pre-install itself as the default search engine is inherently bad for the denizens of the Android ecosystem. If people didn't like Google or if there was an alternative available that was an order of magnitude better, people would switch en masse (Internet Explorer, now Edge, has continued to lose market share even though it continues to be the default browser for Windows machines).

A dictator knows that their hold on power has a finite timespan and thus is incentivized to extract as much value as possible from the economy before that grip weakens and they are eventually forced out of power (or die). Companies face a much more robust feedback mechanism (that of consumer choice) which serves as a great filter for ferreting out bad behavior.

The remit of anti-trust regulators should not be to ensure that there are multiple versions of products with similar feature sets and whose only distinguishing factors are the UI/UX of the products in question. What value does artificially supporting the existence of DuckDuckGo, Yahoo Search, and Microsoft Bing do for the market? Consumers are the ultimate arbiters of what products are delivering value and deserve to survive in the free market. If users are unwilling to explore alternatives for utilities they use on a daily basis why should governments focus efforts on forcing the consumer to make explicit choices between alternatives?

In Other Words

Dictatorial rule in the geopolitical realm is often associated with corruption, monopolies, and bad governance. The spectacular failure of a monopoly in Indonesia in the 1990s serves as a classic example of all three of the above. Monopolies that take away the option of choice are bad for the economy and should be scrutinized, but tech companies today are being lambasted for merely making the "default choice" on platforms they built and control. Consumers have expressed no desire to change this and it isn't clear what harm this is doing or why government regulators around the world have decided that this is a problem worth their attention.

How satisfied were you with this week's issue?

Let me know what you think in this 3 question survey

That’s all for this week. Thanks for making it this far and I hope you found these answers as interesting to read as I found them interesting to write. If you liked what you read, feel free to like, comment, or share it with someone who you think will enjoy it.

As always,

Roosh → You

Besides Google and Apple search functions are free. They make money on data collection of customers buying habits and preferences. So instead of treating them as monopolies, they need some regulations on the user data, so other companies have access to it. Technocrats are smarter than bureaucrats and by the time they come out with regulations, the industry is innovating new things, and we’ll have new market leaders. This is the way of life, too much success is a curse.

Very informative as always, with the added benefit that "Ass insurance" was hilarious. As Archer would say: "PHRASING!"