History of Interest, Analyzing Amazon's CAC & Netflix's Membership Auto-Cancellation

History of Interest (1 min)

Analyzing Amazon's CAC (2 min)

Netflix's Membership Auto-Cancellation (2 min)

How did ancient humans invent a concept as abstract as financial interest?

The answer likely lies in linguistic clues left by past civilizations. The Ancient Greek word for interest, tokos, refers to the offspring of cattle. The Latin word, pecus, or flock is the root word for pecuniary. The Sumerian word, mash, is a term for calves. The Egyptian word for interest, ms, means "to give birth".

Taken together these terms suggest that the origin of the concept comes from the natural population growth that animals experience. You can almost imagine an ancient Sumerian realizing that he should be getting back more than the 5 cattle he lent out last year since those 5 cattle now number 5 cattle and 2 calves.

In Other Words

The etymology of the word interest comes from a concept related to animals giving birth. The theory is that if you lent an animal or group of animals out for a year you'd come back to find those animals had reproduced and as the original owner it would make sense that you were entitled to more animals then you originally had lent, and thus interest was born.

Source: Money Changes Everything: How Finance Made Civilization Possible by William Goetzmann

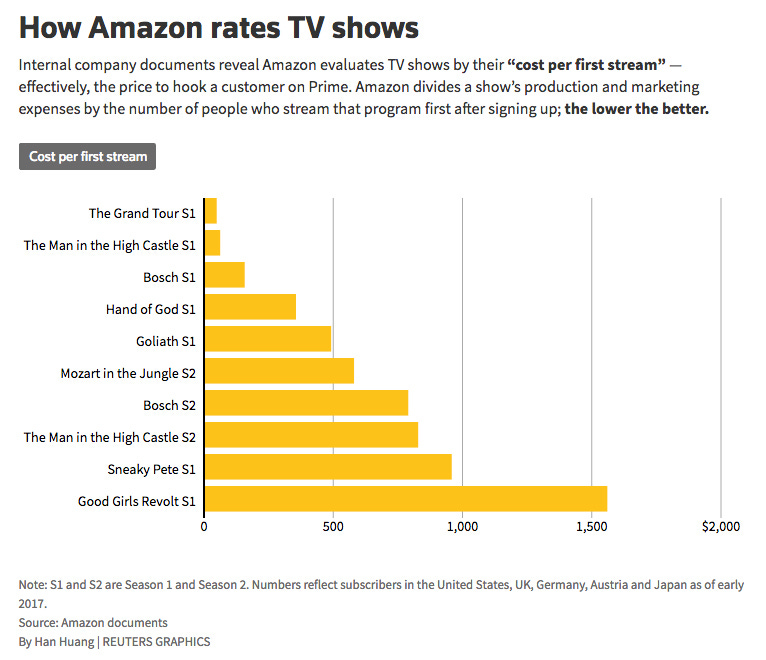

Why does Amazon spend $5 billion a year on Prime Video?

For Amazon it all comes down to customer acquisition and increasing the pool of Prime subscribers. Bezos himself said, "When we win a Golden Globe, it helps us sell more shoes". In fact, in leaked documents cited by this Reuters story (worth the read), "Amazon calculated [The Man in the High Castle] drew new Prime members at an average cost of $63 per subscriber". And this is great for Amazon since the average Amazon customer spends about $600 a year on the site (and the average Prime member spends $1400). Prime video doesn't exist because Amazon thinks it can compete and take market share from Netflix. Prime Video is primarily a route to lowering CAC (Customer Acquisition Cost). This is made more explicit by a metric that Amazon designed called "cost per first stream" which is a factor in program renewal decisions. Essentially they've taken the cost of a production and marketing for their shows and divided it by the number of people who stream that program first after signing up for the service to determine how many prime memberships the show has driven. More informally, "Amazon looked at who was watching a given show and saw how much that person was using Prime for other perks, mainly free shipping. If a Prime subscriber watched a show a lot and wasn’t taking advantage of Prime’s other benefits, the show got credit for that customer’s subscription dollars".

Interestingly if you look at their affiliate commission tables you'll find that driving a new Prime Video trial is worth 2/3 as much as an equivalent trial for Prime Music which seems to suggest that the stickiness of Prime Video is poor compared to Prime Music (which is a topic we'll return to in the next question surrounding Netflix).

In Other Words

Prime Video is a way to decrease CAC for full-fledged prime memberships. Amazon judges shows by an internal metric cost per first stream which divides total cost of the show by the number of people who stream that show first after signing up for the service to determine how many prime memberships the program has driven.

Why did Netflix decide to auto-cancel members who haven't been using their service?

On May 21st Netflix posted the following article on their blog which got quite a bit of media attention. In it Netflix stated that they will auto-cancel memberships of those who do not respond to an email that will be sent out after 1 and 2 years of inactivity (defined as not having used the service in that time period).

According to their 2019 annual report, Netflix sees ~$11 in revenue per user/month which means that if this move costs them 300k subscribers then that'll be a cost of ~$39.6M in the first year (and a much smaller cost going forward) which when juxtaposed against their 2019 revenue ($20 billion) means that this decision will have little first order economic impact on the company.

I think there are two dimensions along which we can analyze Netflix's decision. The first has to do with market saturation.

Netflix currently has 72.9M subscribers in the U.S. There are only ~128M households in the U.S. which means Netflix's growth in its home market can no longer be fully supported by finding new customers. Instead an increasingly important lever for growth in their mature markets will be from reactivations of lapsed subscribers. Viewed from the lens of improving the relationship with subscribers who haven't yet found value/utility from their platform this is a shrewd move, especially when it comes at such a low relative cost.

But this isn't the whole story. There are two undisputed truths in the streaming landscape today. One is that companies in this space have abysmal levels of churn. Hulu, HBO, and Netflix all struggle with getting people to stay subscribed on the platform. But while everyone struggles, Netflix is clearly better at retention (and this lead is even more pronounced when you look at three year retention data) which strongly suggests that they also have less inactive accounts (as a percentage of total accounts).

Netflix understands that if they can pressure other streaming services to adopt a similar pro-consumer cancellation policy that the rest of the industry will suffer much more then they will. This combined with the fact that they are bumping up against the limits of new subscriber growth in the U.S. have led them to take a strong stance on cancellation that while immaterial to their bottom line might reflect badly on other public companies who would see a much larger dip in net subscriber additions should they be forced to implement a similar measure.

In Other Words

The decision costs Netflix a pittance (39M vs 20B 2019 revenue) and helps with two strategic aims. The first is that as they saturate the U.S. market growth increasingly comes from reactivations of lapsed subscribers and this move helps keep that relationship positive. The second is that they are the best at retention (and thus have lower churn than other services) and this puts pressure on other streaming services to adopt similar behavior at what they assume will be higher costs.

That’s all for this week. Thanks for making it this far and I hope you found these answers as interesting to read as I found them interesting to write.

As always,

Roosh → You