Video Game Gambling & Snowfall Futures

This week we return to our regular short-form format and take a look at two exotic corners of the financial system.

Video Game Gambling(2 min)

Snowfall Futures (1 min)

What is the video game skins market and who participates in it?

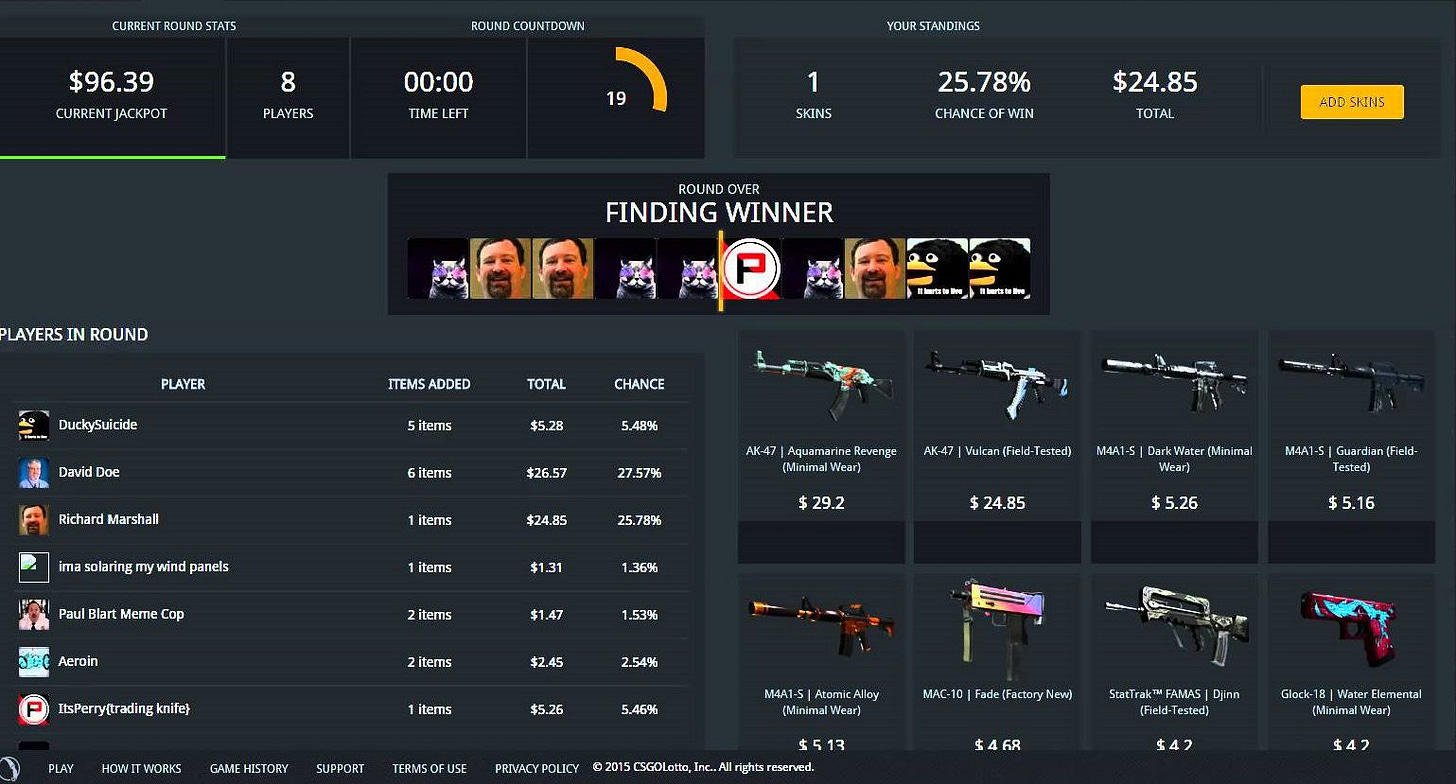

In recent years people have been spending astronomical sums for the right to display custom cosmetic designs on their guns, items, and clothing in multiplayer games. The item below was reportedly sold for $100,000 to a Chinese collector in the game CS:GO. Of course, wherever there is an obscure market with high liquidity that authorities don't understand you can be sure to find two participants: gamblers and money launderers.

There are hundreds of websites that allow you to "wager" any of your virtual weapon-skins on the results of a virtual craps table, the winner of an e-sports match, or the spin of a roulette wheel. Of the $5 billion wagered in virtual skins last year, around 40 percent were bet on esports matches, while around $3 billion flowed through websites offering casino-style games. These sites often disappear, only to be reopened shortly afterward under different domain names, making them impossible to police.

One such site Unikrn, even has it's own virtual currency system that is only redeemable for cosmetic items that can be displayed while gambling in its virtual casino with other people (who are betting "real" currency that they've deposited in the form of virtual skins with real-world value from games such as CS:GO).

Beyond gambling, criminals can use the proceeds of crime to buy virtual currency or a particular item, then sell it — often at an apparent discount — to an unwitting gamer, through a variety of online marketplaces. Most gambling and skin resale sites don't report their numbers publicly but Bloomberg pegged the industry at $50 billion/year.

There have been a few attempts to corral the activities of the people participating in these activities. In 2019 Valve (which owns the Steam marketplace and CS:GO) said that it was banning a particular trading activity on its markets due to their "almost exclusive use by worldwide fraud networks". It's doubtful that this will make a meaningful dent in the usage of virtual items as a way to launder money, but it's still a commendable move by Valve.

As the value of virtual items rises with the ever-increasing supply of gamers it will be interesting to see whether the illegal activity we've seen thus far will continue to grow or will be forced to move to a less popular corner of another market.

In Other Words

Over $5 billion is wagered through the video game skin market every year. The size of this market has attracted criminals who are using the deep liquidity present in the market to launder their ill-gotten gains. Because of its obscure nature, it has been difficult to focus lawmakers' attention on the problem, and the industry has continued to grow.

Why do people bet on how much snowfall there'll be in certain areas of the world?

In 2006, CME Group established the first market for "snowfall futures". Its purpose was to allow individuals and companies to bet on how much snow would fall in cities around the world. As with any specialized derivative product, it's initial customers were found in airlines, snow removal companies, and hedge funds with sophisticated weather forecasting models.

According to NPR, "The average snowfall for winter in Chicago is around 37 inches. So the contracts are like insurance, paying out a set amount of money for every inch over or under, depending on what contract you take out."

As with any form of hedging, participants are investing in insurance in order to smooth out their profits. In this case, the market gives businesses the means to hedge against losses from heavier or lighter snowfall than expected this winter. A snowfall removal company might hedge against the risk of a very light snowfall year because they know that were that to happen they may go bankrupt. Meanwhile, an airline might hedge against excessive snowfall since the delays caused by weather can be extremely costly to them.

In Other Words

Snowfall futures allow companies whose profits are highly dependant on weather-related conditions to hedge against the risk of extreme (in either direction) snowfall years.

How satisfied were you with this week's issue?

Let me know what you think in this 3 question survey

Thanks for making it this far and I hope you found these answers as interesting to read as I found them interesting to write. If you liked what you read, feel free to like, comment, or share it with someone who you think will enjoy it.

As always,

Roosh → You