World's First Cyber Attack, Income Share Agreements & The Waffle House Index

People are often surprised to hear that the first cyber attack happened in the 1800s and I love recounting the story of how it happened. This week we also cover income share agreements and how they (usually) better align incentives between schools and students as well as where else they are being used. Finally, we cover The Waffle house Index which is an informal metric first popularized by former FEMA director Craig Fugate.

World's First Cyber Attack (1 min)

Income Share Agreements (2 min)

The Waffle House Index (1 min)

When was the world's first cyber attack?

Starting in 1789 Napoleon constructed a nationwide semaphore telegraph system that cut the time taken for messages to be transmitted between Paris and the outer fringes of the country from 3-4 days to 3-4 hours. This system (which pre-dated the electric telegraph) functioned by having a string of stations within line of sight of each other stretching across the entire country. Each station housed an operator whose job it was to watch the station ahead of them with a telescope and re-transmit messages they saw using a system of pulleys and wooden beams. In this way, information was efficiently transmitted over vast distances.

However, in 1834 two enterprising bond traders in France realized that this network could be subverted for other purposes as well. The Blanc brothers knew that if they could transmit information about the days price movements from Paris to other parts of the country faster than the information arbitrageurs of their time (who were focused on trying to find better carrier pigeons and horses) that they'd be able to make a lot of money. So they bribed two telegraph operators to insert errors into the sequences they transmitted which would allow their accomplices in other parts of the country to know whether the market had gone up or down for the day. For two years their scheme proved profitable until they were discovered by the government and tried for their crimes.

Luckily for the Blanc brothers, the telegraph was so new that there was no law against what they had done and they were allowed to keep both their freedom and their gains.

In Other Words

Napoleon constructed a nationwide human-operated semaphore telegraph which allowed information to be transmitted across the entire country in hours but limited its usage to governmental and military purposes. Two bond trading brothers realized they could make money by being the first to know about price movements in Paris and bribed two telegraph operators to encode information on bond prices in their messages. After two years they were caught but escaped conviction because there was no law against their actions since the telegraph system was so new.

What are Income Share Agreements and how are they being used today?

Income share agreements (ISAs) are a method of financing that allow someone to forgo future income in return for benefits now. Many coding bootcamps such as Flatiron School and Lambda School offer them to their students. Schools like this allow a student to get a free (or close to free) education with the promise to pay back a certain percentage (10-20%) of their income when they land a job for a specified period of time (1-4 years).

ISAs for students seem to be a great alternative to traditional student debt. There is a strong incentive for the school to train each student to be able to get a high paying job so that the school can make more money from the student. This aligns the student and the school's incentives quite nicely.

However, recently there has been some turmoil with one of the main providers of ISAs (Lambda School). It emerged that they were actually securitizing the cash flows from the ISAs they had gathered and sold them to hedge funds and PE investors. Essentially this means they were getting paid upfront (instead of collecting revenue over time from the student's paycheck) and allowing these hedge funds to collect the "future income" from the students instead.

From the perspective of Lambda School, this makes a lot of sense. They are trading future income for cash now which they can deploy to expand their school and service more students. The hedge funds are getting a nice premium with steady cash flow and are protected from the risk of any single student defaulting by owning a portion of the cash flow from all students in a "cohort" (If this sounds familiar it's because it's also how banks package and sell mortgage-backed securities.

Abstractly there's nothing wrong with trading future income for cash now, especially in such a capital intense business with long payback periods. But there is some truth to the idea that there now exists a weaker correlation between Lambda Schools' educational quality and their bottom line. After all, Lambda School is now getting paid upfront (and therefore before their students have even gotten a job) which means that the clearest predictor of revenue will now be the number of students they are able to graduate instead of the income level of the jobs their students get. (Admittedly the income level still matters because investors won't be interested in buying the income from their students if their performance is weak but that data will take years to surface). After much uproar, Lambda School backtracked and came up with a more complicated financing scheme that ensures they still have skin in the game (their revenue still depends on students' performance) while allowing them to keep selling the ISAs to investors.

Interestingly, ISAs are spreading beyond student debt. Athletes have gotten into the game as well. In 2014 Vernon Davis, a tight end in the NFL, listed 10% of his future income for $4 Million with a now defunct platform called Fantax. In baseball, Minor league players are now joining what they call an "income pool" where if anyone in the pool makes it to the majors they would pay back 10% of their salary (on any income above $1.6 million) to their poolmates.

It's early days yet for these innovative financing schemes. There's even a startup that allows you to exchange equity with other startup founders in the same vertical as you. And another one where you can actually IPO yourself and invest in other people (And yes, I have invested in a few people on the platform). We've yet to see the full effect of how innovative financing schemes will affect our society but I'm quite bullish on what's possible given what we've seen so far.

In Other Words

Income share agreements are a way for schools to align their incentives to their students by ensuring they only get paid if their students find high paying jobs after graduation. One school (Lambda School) was recently found to have been selling the future income of their students at graduation instead of waiting to collect the income over time which caused many people to question how effective the incentive alignment ISAs are lauded for is. Athletes have also used ISAs as a way to hedge against injury or to pool risk and potential for success since so few make it to the elite level.

What is the Waffle House Index?

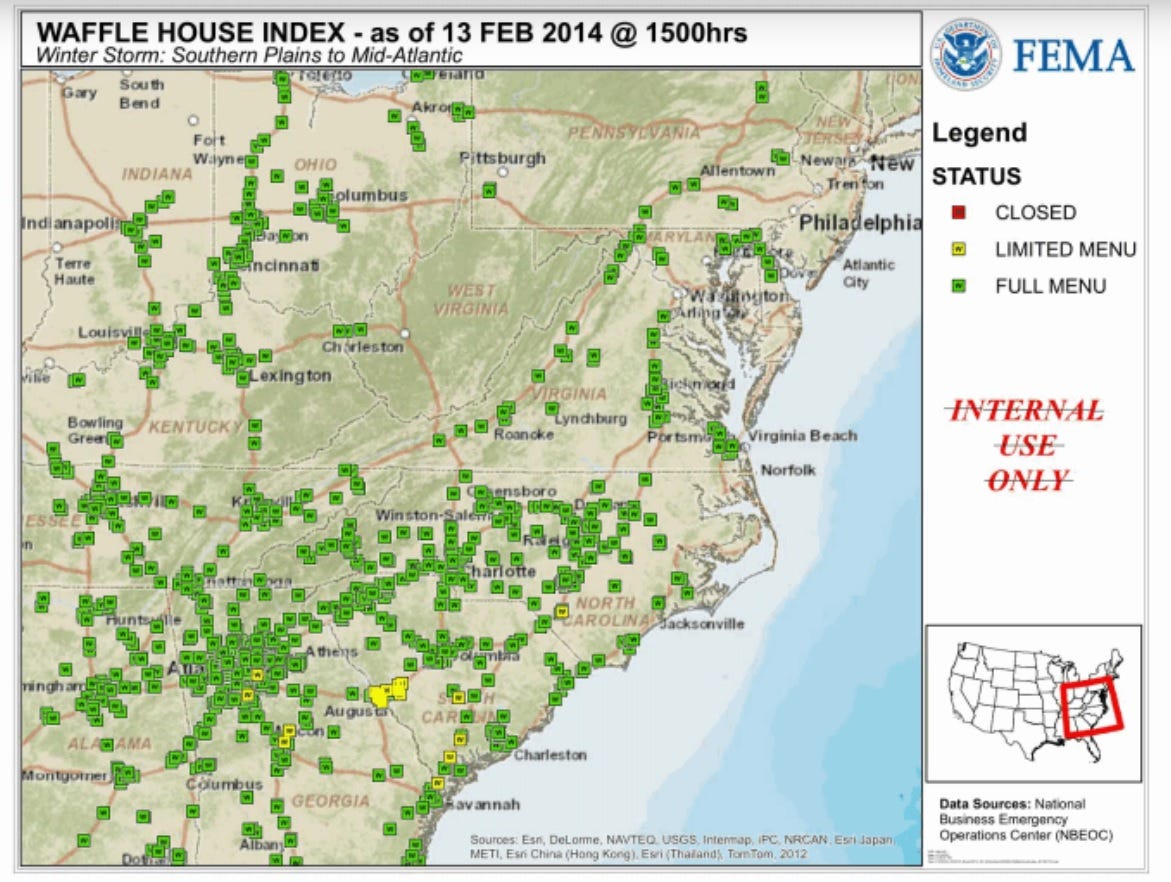

After a natural disaster in the United States, the Federal Emergency Management Administration (FEMA) steps in to assess the damage and to disburse aid and supplies. One of the informal metrics they use to determine how badly an area has been hit (and later how well it is recovering) is to take stock of which Waffle House stores in the region are still operational. Over the years disaster specialists have taken to calling this the "Waffle House Index" and it's proven to be remarkably accurate at predicting where the worst damage has occurred.

This works because Waffle House is famous for not shutting down even amidst conditions that would dissuade the hardiest of businesses. They even have menus available for different disaster situations at all their stores:

The waffle house index isn't the most scientific of indices but that doesn’t diminish its usefulness in disaster situations.

In Other Words

FEMA uses the Waffle House Index as an informal metric to judge disaster severity and recovery across the United States. A system based on the menu and items being served allows them to see at a glance which parts of the country have power, supply lines, and guage general economic activity.

That’s all for this week. Thanks for making it this far and I hope you found these answers as interesting to read as I found them interesting to write. If you liked what you read feel free to share it with someone who you think will enjoy this type of content.

As always,

Roosh → You